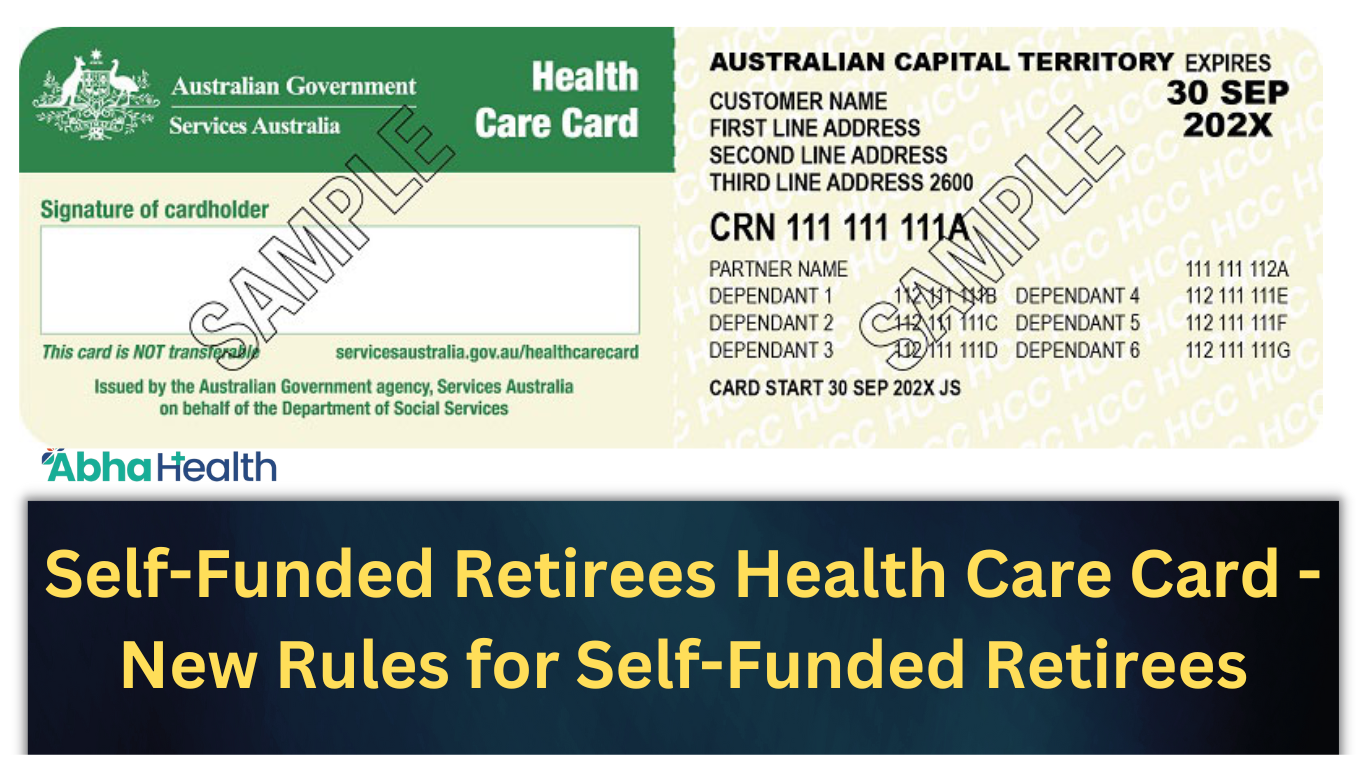

Self-Funded Retirees Health Care Card

Self-Funded Retirees Health Care Card: Retirees are considered self-funded if they are not eligible for an age pension or any other form of government-funded income support. There is no level of super savings that sets the level for being self-financed. In simple language, we can say that if you do not get a pension or any kind of financial benefit from the government. So in such a situation if someone saves some part of his income for himself his retirement planning. That’s what’s called self-financing.

Self-Funded Retirees Health Care Card: If you are looking for Self Funded Retirees Health Care Card along with its elements such as self-funded retirees under 65, new rules for self-funded retirees, self-funded retiree concession card, and self-funded retirees Australia. then this webpage might be helpful for you. Because Here we are providing exactly what you looking for. Let’s have a Look.

New Rules for Self-Funded Retirees

Self-Funded Retirees Health Care Card: From November 2022, the Self-Funded Retiree limits increase significantly. They have now been raised to $90,000 per year for singles and $144,000 for couples. In addition, the limit is raised to $180,000 for couples who are separated for illness and respite care or for prison. This amount increases further for senior citizens caring for a child (or children).

Beforehand, self-funded retirees of a certain age could only access the Commonwealth Seniors Health Card if their income was less than $57,761 for singles, $92,416 for couples, or $115,522 for couples separated by illness.

Self-Funded Retirees Under 65

As we all know Retirees are considered self-funded if they are not eligible for an age pension or any other form of government-funded income support. Therefore, Australian Youngsters who are working in various sectors and are not eligible for any government-funded scheme may decide on their retirement plan at the age of 65 along with retirement savings.

Self-Funded Retiree Concession Card

Retired subscribers receiving the Age Pension are automatically issued with a Pensioner’s Concession Card (PCC) which gives access to a number of additional government benefits, even when retirees are not eligible for the Age Pension It might be worth exploring other concession cards, including Commonwealth. Senior Health Card (CSHC) and Low Income Health Care Card (LIHCC).

Self-Funded Retiree Concession Card Benefits

- Local rates on medicines listed under Pharmaceutical Benefits

- Fine billing for doctor appointments.

- Out-of-Hospital Medical Discounts Above Medicare Net Guarantee Limit

- Discounts on certain services provided by Australia Post, such as mail re-direction

PCC cardholders can also take advantage of discounts on Hearing Tween 2 and Telstra Home services.

Self-Funded Retirees Australia

Self-funded retirement is frequently seen as a fortuneless relation to getting an age pension. Certainly not. Back in 2019, the Superannuation Funds Association of Australia (ASFA) predicted that one in two (43%) Australians of retirement age would be self-funded by 2023, up from 22% in 2000.

For More – Visit Here

You May Also Like: